When it comes to operating systems, the mobile computing market is for the most part owned by Microsoft, especially in the warehouse and logistics space. However, with the introduction of Windows 8, there are questions as to whether that will create opportunities for alternative operating systems, Krebs says. “If a company is upgrading its hardware, it may look into other options available on the market,” he says. “Microsoft is struggling in terms of mobile strategy. You see the results of that in the mobile market.”

Krebs is watching a few key trends:

Multi-modal solutions, such as the combination of voice and bar code scanning or voice and light-directed picking, continue to gain steam as companies grapple with how to fill e-commerce orders accurately and efficiently. “As greater volumes of orders are fulfilled through electronic channels and as retailers look to provide customers with more options, the need for warehouse and logistics functions has to change,” he says. “We’ve seen this most acutely in the drive toward the perfect order as a key metric of performance. We see integration and deployment of multiple types of data collection technology to support those more stringent metrics.”

Form factors are also changing in the mobile market, as wearable technologies become more accepted and as interfaces migrate from keystroke-intensive approaches to touch-based designs. “We see the influence of consumer technologies in warehouse environments, including the design of both hardware and applications around touch as an input methodology,” Krebs says.

Wearable, intuitive systems facilitate a greater emphasis on efficiency in the warehouse. “An improved process is one thing, but labor management and the efficient, on-the-fly redeployment of labor is also key,” Krebs says.

Scanning and printing: Although market totals remain virtually unchanged in 2012, the totals reflect a significant uptick in the number of customers migrating from scanning to camera-based imaging, particularly on the handheld side.

“The transition has been much faster than expected,” says Richa Gupta, the VDC senior analyst for the Auto-ID market. Although camera-based imaging technology has been around for more than 10 years, it was not until recently that the prices fell to more appealing levels. “Many leading vendors were not expecting customers to switch as fast as they did,” says Gupta. “Laser scanners are on the decline and will continue to be. Camera-based imaging solutions are the future.”

As with 2011, camera-based 2D imaging solutions saw the largest area of growth, expanding by more than 30%. That growth is largely being driven by retail markets, where functionality such as scanning a bar code from a customer’s smart phone is becoming increasingly important.

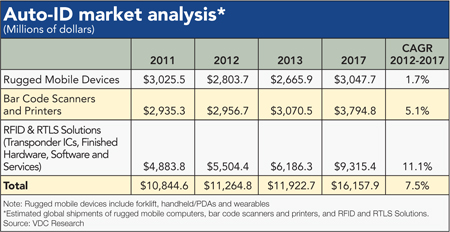

Handheld scanners jumped nearly 7% to $945 million, while the market for industrial fixed scanners increased by just 1% to $675 million, according to Gupta. Meanwhile, the market for industrial printers, which includes bar code printers and the RFID printer/encoder market, declined more than 2% to $1.33 billion. However, Gupta sees growth returning, projecting a five-year CAGR of 5.1%.

粤公网安备 44010602003952号

粤公网安备 44010602003952号