Our list grows top heavy following another big merger, but after a year of relative calm, the market is heating...

Our list grows top heavy following another big merger, but after a year of relative calm, the market is heating up once again.

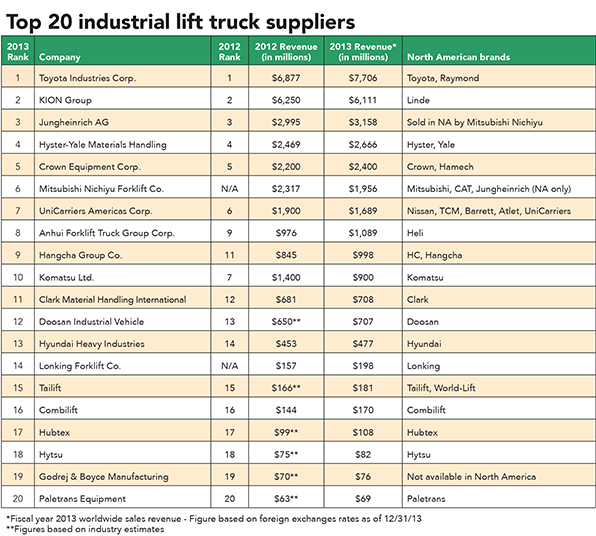

The past few years have been a roller coaster for the lift truck industry, which has proved innovative and resilient enough to rapidly overcome the tumult of the Great Recession. But the market is a far cry from its pre-downturn self, as fleet management and a proliferation of new technologies have reshaped how lift trucks are procured and used. Thankfully for all stakeholders, the market is now enjoying increased stability, as evidenced in Modern’s annual list of the Top 20 lift truck suppliers.

Brian Butler, chairman of the Industrial Truck Association (ITA) and president and CEO of Linde Material Handling North America, says last year’s strong 5% growth in unit sales is on track for a repeat performance. But the transactions will look very different as fleet owners increasingly value and quantify the impact of a lift truck on the entire business. Butler suggests the changing and deepening relationship between suppliers and end-users is not unique to the lift truck market.

“Customers are becoming smarter about materials handling in general,” Butler says. “They will continue to be diligent about managing their businesses, but 2009 opened a lot of people’s eyes. They’re looking harder at a huge wealth of opportunities and longer-term solutions.”

Traditionally, a business might spend in some areas and squeeze others, Butler says. Lift trucks were often among the first places to see spending cuts, but increased visibility into total cost of ownership has exposed the true costs of maintaining aging equipment. “Investment in a fleet is a way to improve productivity,” Butler says. “We find some customers are buying units earlier or in greater numbers because they can actually see savings while improving productivity. For those who haven’t bought a lift truck in the last five years, there are a lot of things they might not be aware of, but all OEMs are prepared to have those discussions.”

Growth by region

The Worldwide Industrial Truck Statistics (WITS) organization tracks quarterly and monthly statistics on lift truck sales, and is compiled by six trade groups based in North America, Brazil, Japan, Korea, Europe and China. According to the 2013 WITS figures, global orders increased by 7% from 944,405 to 1,009,777. This follows a 3% decline in orders in 2012. Shipments were up 5% after staying level from 2011 to 2012.

![]()

Since 2008, shipments to the Asia region have increased 46%, while shipments to the Americas rose 6% over the same period. Europe’s shipments have yet to recover from the losses of the recession, with shipments down a total of 21% since 2008. Globally, shipments are up 7% in the last seven years. Highlights of the 2013 WITS figures include:

粤公网安备 44010602003952号

粤公网安备 44010602003952号