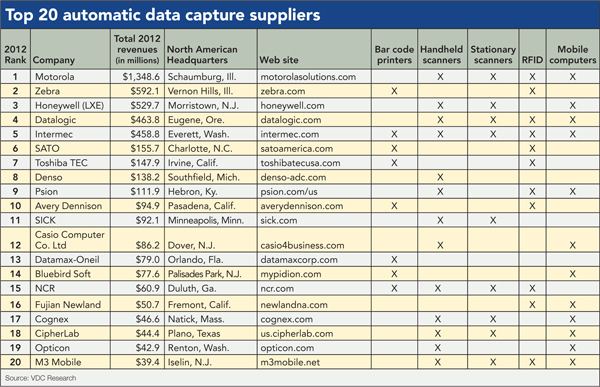

To make our list, companies must sell in North America, though the chart includes worldwide revenues. Modern does not include resellers, systems integrators or other companies that do not manufacture ADC hardware. Since our readers are primarily focused on supply chain solutions, we do not include companies whose primary focus is the retail checkout counter or non-industrial settings like hospitals, libraries or resorts. Nor do we include companies that only manufacture consumables like bar code labels and RFID tags.

Market by market

The Auto-ID market is made up of three distinct industry segments, each with its own distinct dynamics—mobile computing, scanning and printing, and RFID. Here are the most important developments in each market.

Mobile computing: The market for ruggedized mobile computers reached $2.803 billion in 2012, says David Krebs, vice president of VDC’s enterprise mobility and connected devices. Those figures include handheld/PDA devices, wearable mobile computers and lift truck-mounted devices used on the plant or DC shop floor or in port and yard applications.

Krebs estimates the overall market for mobile computing devices will grow by a CAGR of 1.7%, reaching about $3 billion by 2017. As with 2011, transportation and warehousing continued to drive investment in mobile computing. And, while 2012 saw a continuation of the recovery that started in 2010, Krebs is expecting some changes in 2013.

“The rugged handheld market is in the midst of a fair amount of change,” says Krebs, who says market conditions have not been good from a top line perspective. “We saw contraction last year and expect it again this year.” One factor is macroeconomic, such as struggling European markets that have caused some tension in terms of investment strategies, Krebs says.

The second factor is technical, with disruption in industrial mobile computing increasingly defined by consumer-grade equivalents. “These technologies find their way into an enterprise through the back door, with things like ‘bring your own device’ programs. Enterprise-deployed programs, while they do happen, are not the norm,” Krebs says. The availability of consumer products makes it difficult for traditional rugged vendors to compete, but the lack of support tools is leading to decreased acceptance of consumer devices for enterprise-level data access. “The pain threshold is also difficult to overcome in the event of failure of these consumer devices,” Krebs says. “At the end of the day, customers want something as reliable as possible, and that’s a premium the market is willing to pay for.”

粤公网安备 44010602003952号

粤公网安备 44010602003952号