The next strongest growth was in the Americas, where a 6% increase in shipments saw about 220,000 units shipped. According to figures from the ITA, nearly 180,000 of those are United States sales, as compared to 166,000 units in 2011.

Asia saw a slight decline in orders (-4.4%) and shipments (-2.6%), but still shipped 363,816 units, or 39% of global shipments.

Europe’s orders fell 6%, with shipments down 2%, for a total of 317,726 units shipped.

The Top 10

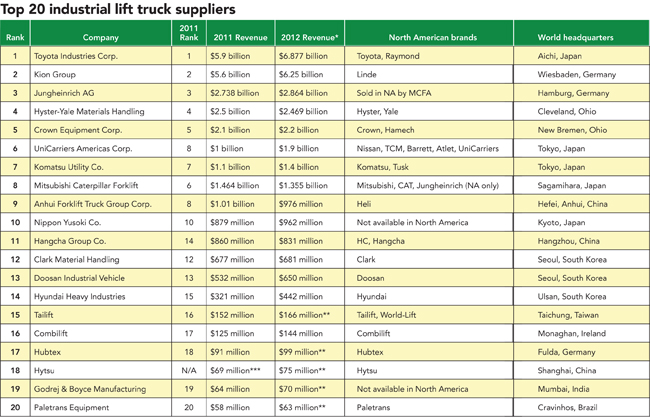

With revenues up 16.6%, Toyota Industries Corporation once again claimed the No. 1 spot, staying ahead of Kion Group. Toyota’s $6.88 billion is $620 million more than Kion’s $6.25 billion, with the leader’s revenues 10% larger than the challenger’s. In 2011, Toyota was 5% ahead of Kion, which grew by nearly three quarters of a billion dollars between 2011 and 2012.

The rest in the top five are familiar faces. Jungheinrich again ranks third with 4.6% growth to $2.86 billion. Hyster-Yale Materials Handling (which previously reported as NACCO Industries; NACCO’s materials handling business was spun off in mid-2012) held fourth despite a roughly 1% drop in revenues for a total of $2.47 billion. Appearing again in fifth is Crown Equipment with 4.8% growth to $2.2 billion.

In sixth place is UniCarriers, the result of a merger between last year’s eighth-place finisher, Nissan Forklift, and last year’s 11th-place finisher, TCM. Combined, the companies’ individual revenues in 2011 were $1.75 billion. The new entity sits at about 8.6% above that, with 2012 revenues of $1.9 billion.

In seventh place for the fourth year running is Komatsu, which posted $1.4 billion for 27% growth, the largest growth percentage on the list.

Dropping two ranks to eighth place, Mitsubishi Caterpillar Forklift (MCF) reported $1.355 billion in 2012 revenues, down 7% from last year. In June of 2012, the company restructured its forklift production, with plans to transfer production of small- and medium-sized forklifts from Japan to facilities in China and Houston, Texas, by the end of 2013. The move was intended to bring production closer to target markets.

After launching a number of new products, in November of 2012 Mitsubishi Heavy Industries (MCF’s parent company) announced plans to merge its forklift business with that of last year’s 10th place finisher, Nippon Yusoki, by April 2013. Representatives for the new entity, Mitsubishi Nichiyu Forklift Co., Ltd., confirm they intend to report jointly next year.

Holding steady in 2012 with $976 million in revenues, No. 9 Anhui Forklift, the Chinese makers of Heli forklifts, fell slightly off the $1 billion in revenues it has posted in the previous two years, for a drop of 3.4%.

Rounding out the Top 10 is Mitsubishi Nichiyu Forklift, which reported last year as Nippon Yusoki Company. With $962 million in revenues, the company saw more than 9% growth.

Breaking down the Top 20

The TCM/Nissan merger has shaken things up for the top half of the list. By next year, it could take more than $1 billion in revenue to crack the Top 10. Combined, the Top 10 companies collected more than $27 billion in revenues in 2012, just $126 million less than the entire Top 20 list of 2011. In that year, the Top 10 accounted for about $24 billion, meaning the top half of the list has grown by almost 13%.

The Top 5, all of which are the same companies as last year, have fared well, growing by a combined $1.86 billion, or nearly 10%. For the lower half of the list, companies ranked 11 through 20 gained a combined $272 million in revenues, a 9% increase.

Trends to watch

Moran says the lift truck is increasingly becoming a platform for technologies that enable better processes and better productivity. “What people are looking for now is technology for efficiencies beyond the truck, beyond incremental improvements in truck performance like lowering a little faster or traveling a little faster,” he says. “Customers are looking for add-ons that can make their workforce better and more efficient.”

粤公网安备 44010602003952号

粤公网安备 44010602003952号