The dust has settled. Following two years of very strong growth in lift truck sales, shipments leveled off in 2...

The dust has settled. Following two years of very strong growth in lift truck sales, shipments leveled off in 2012. With growth at just a fraction of a percent, worldwide sales didn’t match the 27% growth in 2011 or the 32% growth in 2010. Of course, those years came on the heels of a 39% contraction, and many in the industry remain excited to see growth of any kind, however small.

Jim Moran, chairman of the Industrial Truck Association (ITA) and former senior vice president of Crown Equipment, is among them. According to Moran, the growth might be smaller, but it’s more stable as a result of more intelligent practices on the part of both lift truck manufacturers and their customers. Procuring, utilizing and replacing a piece of equipment means something different than it did just a few years ago.

“Large fleet owners have modified their replenishment cycles,” says Moran, “They just aren’t replacing their lift trucks in the same time frame they were. They’ve discovered, probably, that they can get away with that as long as they’re keeping an eye on maintenance costs and utilization. We’re on a slower but more sustainable curve instead of having a great year, then a slow year, and then falling behind.”

The worldwide picture looks to have reached a plateau, but news is good for this year’s Top 20 lift truck suppliers. Of those who reported their revenues to Modern, only three saw year-over-year decreases. These small, roughly 3% reductions could simply be due to currency conversion rates. As a whole, however, the Top 20 bested last year’s $27.2 billion in revenues by $3.2 billion dollars—an 11.8% increase, breaking the $30 billion mark by nearly half a billion dollars, and coming in around $30.4 billion.

Growth by region

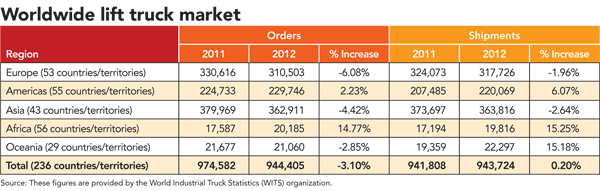

The Worldwide Industrial Truck Statistics (WITS) organization tracks quarterly and monthly statistics on lift truck sales, and is compiled by six trade groups based in North America, Brazil, Japan, Korea, Europe and China. According to the 2012 WITS figures, global orders fell by slightly more than 3% in 2012, from 974,582 units to 944,405 units. Shipments crept up 0.2%, finishing at 943,724. Highlights of the WITS figures include:

After posting the lowest growth rates in 2011, Africa now boasts the strongest growth, with a near 15% improvement in orders and shipments. Nearly 20,000 units were shipped to African countries in 2012.

In Oceania (Australia and nearby islands), shipments were also up more than 15%, with 22,297 units shipped.

粤公网安备 44010602003952号

粤公网安备 44010602003952号