Just as an effective materials handling system cannot be shaped around one data point, interpreting the results o...

Just as an effective materials handling system cannot be shaped around one data point, interpreting the results of an industry survey is about more than just the bottom line.

For instance, take a look at the average materials handling budget as reported by Peerless Research Group (PRG) in the 2013 State of Warehouse/DC Equipment and Technology Survey. At nearly 26% less than last year, the average anticipated spending among the survey’s 597 respondents is just $334,510. In fact, about half of those respondents plan to spend less than $50,000.

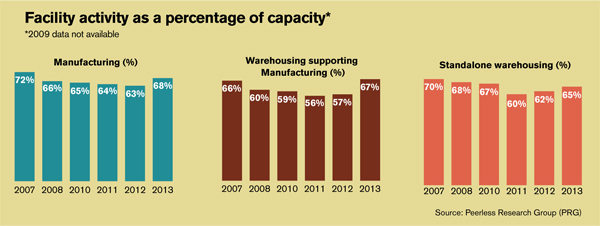

But if we look at activity levels, facility capacity numbers have jumped up by as much at 10% in one year—following six consecutive years of decline. According to John Hill, director at St. Onge, capacity figures between 60% and 70%, although a big improvement, are still below a certain threshold. When they rise above 70%, he says, it’s often necessary to spend on materials handling equipment just to keep up. In the meantime, most businesses will tend to sit tight.

“In the past couple of years, we saw the effect of delayed spending,” says Hill. “Now, many have caught up; and unless growth is phenomenally good, there won’t be as much pressure to spend. We’re looking at modest growth that perhaps many feel they are able to handle.”

In fact, respondents expressed a great deal of optimism that they could handle it. When asked about their anticipated activity levels over the next two years, almost 95% said that they expected activity to increase or stay the same. To be fair, more than 50% of respondents suggested their warehousing activity would stay the same.

According to George Prest, CEO of Material Handling Industry (MHI), growth is projected to improve into 2014. Following industry growth rates of 14% in 2011 and 10% in 2012, 2013 could hover around 6% before breaking double digits again in 2014.

“We’re on the declining side of the growth curve,” says Prest, “but we can expect to see things trending upward from here. Specific industry segments will pick back up at different times, but the overall outlook is good.”

Demographics and reduced spending

This year’s respondent base of 597 is about twice last year’s base of 314 survey responses. However, according to Judd Aschenbrand, director of research for PRG, the demographic breakdown of the group remains statistically similar to last year.

One notable change is in the level of participation in the southern and southeastern part of the country, where 20% of respondents are located—as compared to just 10% in last year’s results. Aschenbrand also pointed to the political and economic climate at the time of the survey, which was fielded in January as President Obama was poised to begin his second term.

粤公网安备 44010602003952号

粤公网安备 44010602003952号